关于我们

ABOUT US

关于我们

ABOUT US|

乐鱼平台-乐鱼(中国)一站式服务平台公司成立于1995年,是由中国科学院、原机械工业部和原电力工业部共同发起成立的融产、学、研于一体的高新技术企业。 公司以中国科学院工程热物理研究所在涡轮机械气动、热力学方面的科研成果为基础,联合公司创始人哈尔滨工业大学、清华大学、北京航空航天大学、哈尔滨汽轮机厂有限责任公司、东方汽轮机有限公司、上海汽轮机有限公司、北京北重汽轮电机有限责任公司等科研机构及制造企业,历经近二十年产、学、研相结合的探索,开发了具有自主知识产权和当代先进水平的汽轮机乐鱼平台-乐鱼(中国)一站式服务平台设计技术,并成功地实现了技术走向市场,形成产业化。 |

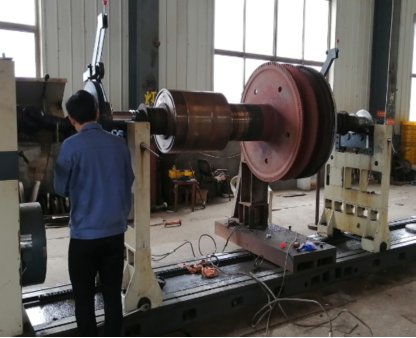

PRODUCT CENTER

产品中心

产品中心

PRODUCT CENTER

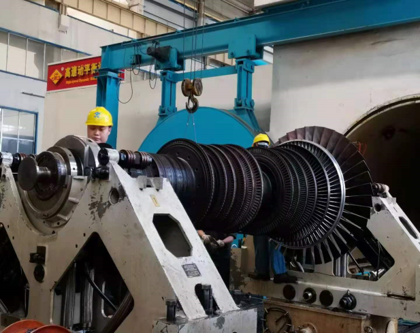

EXCELLENT PROJECT

精品工程

精品工程

EXCELLENT PROJECT

您的留言将即时发送到我们的邮箱

在线留言

在线留言

您的留言将即时发送到我们的邮箱

|

|

|

*

*

提交